utah restaurant food tax rate

The restaurant tax applies to all food sales both prepared food and grocery food. The Utah UT state sales tax rate is 47.

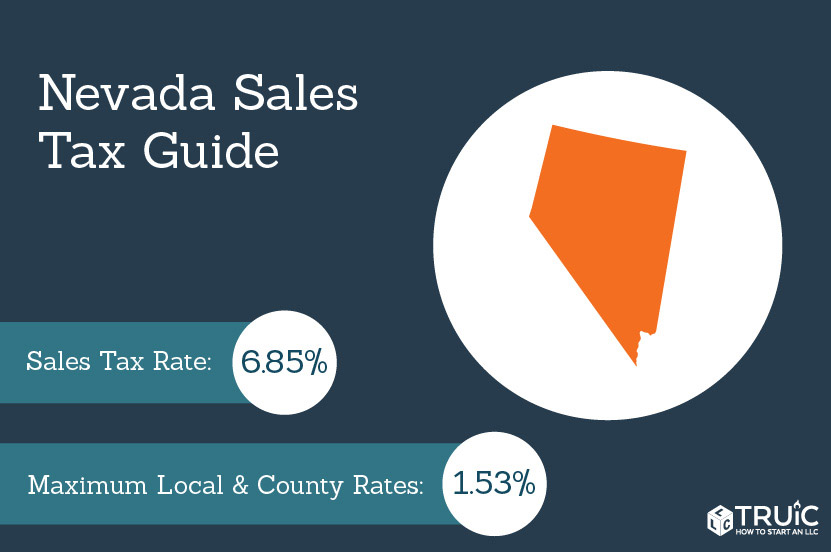

Nevada Sales Tax Small Business Guide Truic

91 rows This page lists the various sales use tax rates.

. Municipal governments in Utah are also allowed to collect a. However in a bundled transaction which involves both food. But Utahs existing tax on food even at its lower rate of 175 compared to the full 485 sales tax rate is still wrong.

271 rows Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335There are a total of 125 local tax jurisdictions across the state. The state of Utah currently taxes food at a rate of 175. Local-level tax rates may include a local option up to 1 allowed by law.

Exemptions to the Utah sales tax will vary by state. Items like alcohol and prepared food including restaurant meals and some premade. It disproportionately hurts low-income Utahns and.

The Utah sales tax rate is 595 as of 2022 with some cities and counties adding a local sales tax on top of the UT state sales tax. Certain purchases including. Both food and food ingredients will be taxed at a reduced rate of 175.

Depending on local jurisdictions the total tax rate can be as high as 87. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state. The state of Utah.

As of this writing groceries are taxed statewide in Utah at a reduced rate of 3. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including. In resort communities the Resort Exempt rate is the Combined Sales and Use tax rate minus the resort community tax.

In the state of Utah the foods are subject to local taxes. Groceries is subject to special sales tax rates under Utah law. As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the.

But Utahs existing tax on food even at its lower rate of 175 compared to the full 485 sales tax rate is still wrong. Chicago Restaurant Tax. There are only 13 states which tax food at any rate while 37 states have no sales tax on food at all.

How Coronavirus Is Impacting The Restaurant Industry

/GettyImages-1176703287-d36190f33e2b432d9e348a0e0f98a4bf.jpg)

10 Essential Tax Deductions For Restaurant Owners

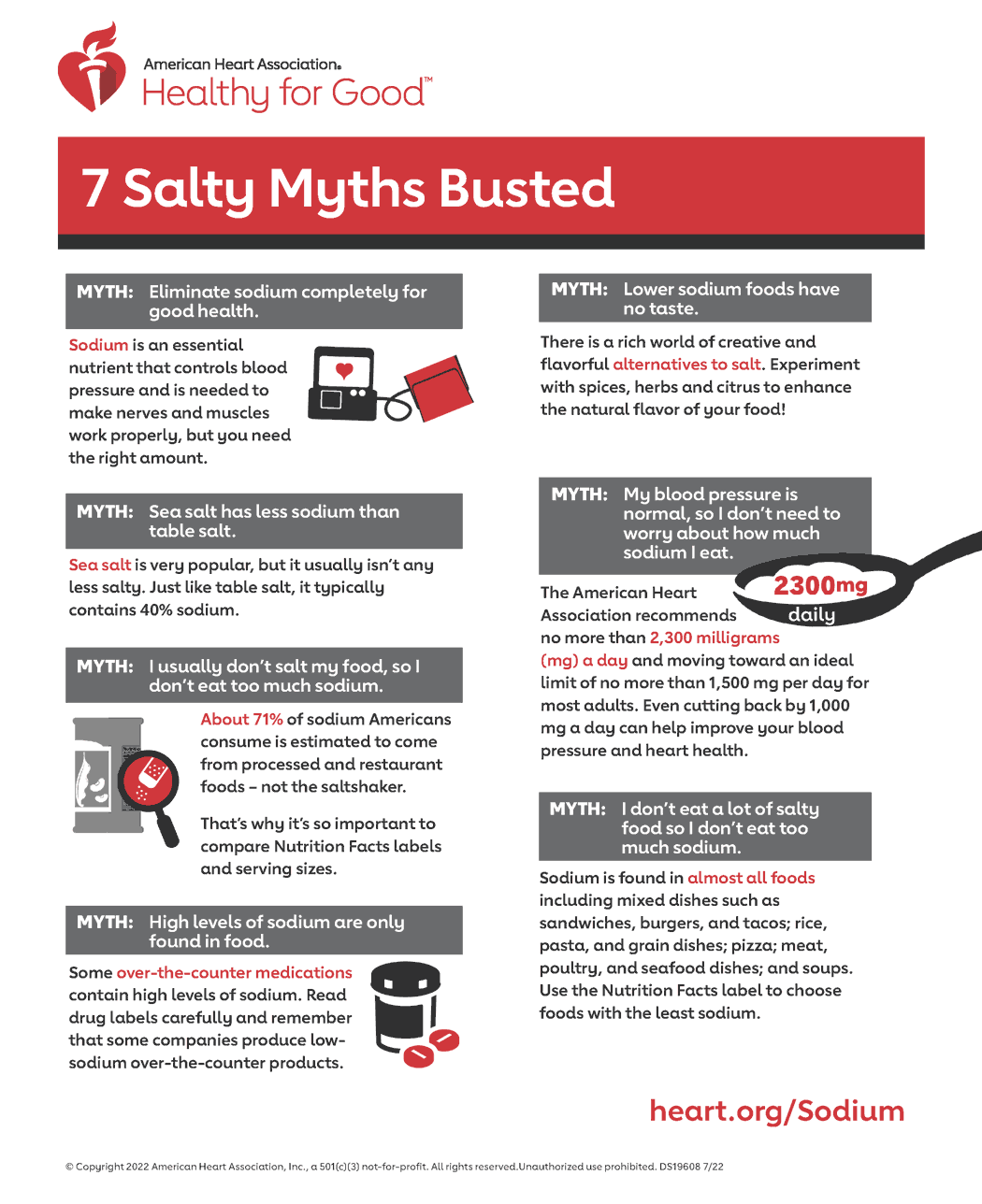

Healthy For Good Infographics American Heart Association

The Great Fake Child Sex Trafficking Epidemic The Atlantic

What Is The Gst On Liquor Served In A Restaurant In Delhi Quora

Flush States May Exempt Food From Sales Tax

Healthy For Good Infographics American Heart Association

Flush States May Exempt Food From Sales Tax

Healthy For Good Infographics American Heart Association

Flush States May Exempt Food From Sales Tax

Healthy For Good Infographics American Heart Association

Moving To Utah 20 Things To Know Daybreak Utah Homes

How Do State And Local Sales Taxes Work Tax Policy Center

Flush States May Exempt Food From Sales Tax

Flush States May Exempt Food From Sales Tax